If you’re part of a faith-based organization or considering starting one, you might have come across the term "508(c)(1)(A)." This designation has significant implications for religious groups, particularly those seeking a way to establish and operate as tax-exempt entities with greater privacy and fewer restrictions than the more commonly known 501(c)(3) designation. In this blog, we’ll break down what 508(c)(1)(A) is, how it compares to other tax-exempt statuses, and why it might be an appealing option for faith-based groups.

Section 508(c)(1)(A) is part of the Internal Revenue Code (IRC) in the United States, specifically designed to provide tax-exempt status for certain types of organizations. While many are familiar with 501(c)(3) tax-exempt status, particularly for charities, 508(c)(1)(A) serves as an alternative path primarily reserved for churches and religious organizations. Unlike 501(c)(3) organizations, which need to apply for and maintain tax-exempt status through formal IRS documentation, 508(c)(1)(A) entities enjoy automatic tax exemption by virtue of being a religious organization.

- Automatic Tax Exemption: Churches and certain religious entities are granted tax exemption automatically, without the need to file IRS Form 1023, as is required for 501(c)(3) organizations.

- First Amendment Protections: The 508(c)(1)(A) designation provides additional privacy and autonomy, helping faith-based organizations operate without substantial government interference, due to protections offered under the First Amendment.

- Reduced Reporting Requirements: Unlike 501(c)(3) organizations, which must file the annual IRS Form 990 to disclose financial information, 508(c)(1)(A) entities are typically exempt from this requirement, preserving more of their privacy.

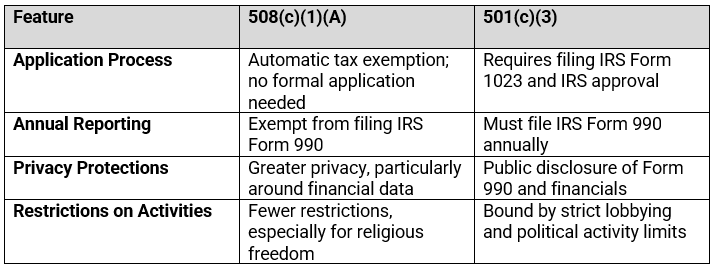

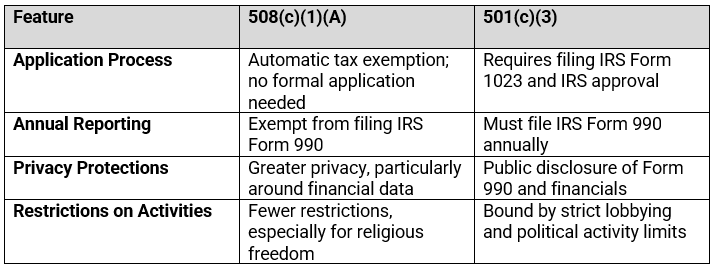

While both 508(c)(1)(A) and 501(c)(3) designations offer tax-exempt status, the way they function and the requirements they entail differ significantly.

- Privacy and Autonomy: With minimal IRS filing and reporting requirements, 508(c)(1)(A) organizations can operate with greater discretion, focusing on their religious mission without disclosing detailed financial data to the public.

- Enhanced Religious Freedom: The First Amendment rights afforded to 508(c)(1)(A) organizations allow for more flexibility in how these groups operate and express their religious beliefs. This can be especially valuable in preserving the integrity of the mission and practices that are central to the faith.

- Automatic Status: Organizations under 508(c)(1)(A) don't need to go through the lengthy IRS application process required for 501(c)(3) status. This means they can begin their mission-driven work with tax-exempt status right away.

Choosing between 508(c)(1)(A) and 501(c)(3) status depends on your organization's mission, goals, and desired level of privacy and autonomy. Here are some questions to consider:

- Is your organization primarily religious or faith-based?

- Do you value privacy around financial records and operations?

- Is avoiding lengthy IRS applications and annual disclosures a priority for your organization?

If the answer to these questions is yes, then 508(c)(1)(A) might be a suitable option for you. However, if your organization has broader charitable goals beyond religion and doesn't mind public financial disclosures, a 501(c)(3) status could still be a good fit.

508(c)(1)(A) provides a unique path for churches and religious organizations to fulfill their missions while enjoying certain freedoms and protections not available to other nonprofits. By understanding the distinctions and benefits of this designation, you can make an informed choice that aligns with your values and operational needs. Whether it’s privacy, simplicity, or greater religious freedom, 508(c)(1)(A) offers faith-based groups the tools to thrive.