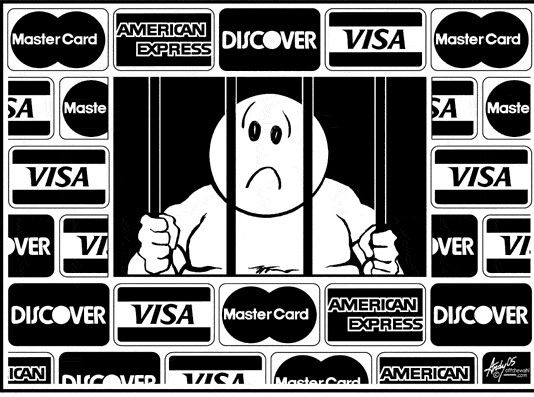

Debt collection businesses are one of the most complained

about businesses, they are third party businesses that work with lenders to

collect their debts. A lender for example a bank, cannot wait for the whole

term of the loan to collect the repayments as this would reduce their liquidity.

Instead they sell the promissory notes to third party for example the Federal

Reserve to generate immediate cash and the debt that was already in their

books, effectively gets settled when they receive money for the promissory note

that the borrower gave to them.

The money from the borrower however still needs to be

collected in theory and since lending institutions cannot be bothered to wait

that long, they sell their debts to debt collecting agencies. These debt

collection agencies purchase the debts from lenders at a discounted price and

then use their own means to collect payments from the borrowers.

What many people do not realize that these debt collectors

do not have a fair ground to stand upon in the court of law and if borrowers

are aware of their rights and some intricacies of the law then they can very

easily not only argue their case but also emerge victorious.

The first step that a debt collector will take is to send you a claim of the debt that you owe. At this point you as a borrower have three main choices

- Reject the claim and ignore it

- Accept it and pay

- Accept it and return it with a counter claim

Let us look at the consequences of each of these choices first.

If you decide to ignore the claim then it will expire within a few days (10 days) and if you do not respond to the claim then the court will rule in favor of the debt collector by default. This is not the most sensible court of action.

If you decide to accept

the debt collection claim and repay the debt, then that is your own choice

but remember that once again this is not the most sensible choice because there

is a way, using the law that you can get out of this tricky situation because

your original debt was discharged. Technically the debt doesn`t even exist

because the lenders sell the promissory notes when they securitize their debts.

The third option is going to be the subject of this

discussion. If you receive a claim for debt then you have roughly 10 days to

respond to it. Within these 10 days you need to accept it and return it to the debt collector with a counter claim.

This counter claim will then have 30 days and the burden will now be on the

debt collector to respond to the counter claim.

What is a counter claim?

A counter claim is a claim made by a defendant in a legal

action. It is a claim made to offset a prior claim. It is a way of giving the

creditor or the debt collector more time to consider the fact of the matter.

Why should the creditor or debt collector be given some time to consider it?

However, it is not necessary that a debt collector withdraw

his claim. In that case it is important to understand the legal grounds upon

which the counter claim has to be constructed.

As we mentioned before, a counter claim provides additional facts to the debt collector to consider before proceeding. If it has already reached the court then the borrower can ask the court time for discovery.

What is Discovery?

“Discovery” is a procedure that happens before the trial

begins. Each party can request the court to obtain evidence from the other

party through discovery devices. So, if the claim for debt isn`t settled

administratively, it is entered into the court and proceedings begin.

Grounds for Counter Claim

Debtors or borrowers must understand the bare facts first. Suppose a borrower mortgaged their house and in order to create a mortgage the borrower and sent a promissory note to the lender, which is basically a promise to pay the amount due in future.

That promissory note is a negotiable instrument but the

lender cannot technically negotiate it. Because if the lender sells the note

for cash, then the promissory note issued by the borrower/debtor stands

discharged, the liability in the books is discharged and the borrower no longer

owes any amount to the lender. For the note to be used as a legal tender, it

has to be registered with a lien and the security on it needs to be perfected,

then only can it be used as a legal tender. Mostly, this is not done and many

borrowers do not realize this either.

Furthermore, whatever mortgage payments are made by the

borrower from this point onwards, are in fact a liability for the lender and

asset for the borrower. You as a borrower, do not technically owe any money

because the lender has already exchanged your promissory note for liquidity.

But the reason that this system works is because the person or let us assume

that FED purchased the promissory note from the lender. So now FED is expecting

cash inflow from the repayments but you as a borrower do not owe anything to

the FED (unless the note was registered) . You owed your mortgage to your

lender and the bank has already settled your note when it was negotiated.

This is the basic ground for filing a counter claim, there are legal flaws here that can be used to get out of this situation. The aim of the counter claim is to look at the balance sheet of the lender. For the reason mentioned above, if the lender shows their Balance sheet in the court, it will become apparent that the original debt was discharged when the promissory note was exchanged.

Furthermore, assessing the balance sheet will also reveal

how much the lender owes to the borrower. So the counter claim is to ask for a

recoupment or an offset.

Lending institutions make use of legal loopholes to exploit

borrowers and if you as a borrower are aware of these loopholes and your

rights, then you can use the same system to claim back your rights. This is not

difficult; it only needs us to be aware of the law and our rights.

Counter claim defenses

The counter claim should now be based on the following

defenses.

Revocation of the

contract

Since the original contract is of a very deceptive nature,

it should be revoked if the lender refuses or does not provide full access to

the books, documents and relevant accounting records. According to the Truth in

Lending Act, any contract can be revoked if proper disclosure has not been

provided. Mortgages may be exempt from this option, however if the lender has

initiated foreclosure proceedings then they are no longer exempt and thus the

borrower/debtor can use the defense that the lender stated incurred amount of

the mortgage, as the original debt had already been discharged.

Request records of

the lender in discovery

Doing this, as we mentioned above will reveal the fact that

in reality, it is the lender who owes liability to the debtor. This will create

the grounds for an offset. Some of the

records that should be requested are:

- FR 2046 balance sheet,

- 1099-OID report,

- S-3/A registration statement,

- 424-B5 prospectus and

- RC-S & RC-B Call Schedules

Debt Collector

cannot claim the property

The promissory note issued by the borrower, is a legal

tender and it becomes an asset for the mortgage originator. The originator or

the institution that created the mortgage, becomes an entitlement holder in the

asset and can claim it if the borrower fails to repay the debt. The debt collector

on the other hand, does not have any right to lay any claim or ask for

repayments.

Lender cannot sell

an unregistered note

The promissory note created by the borrower is unregistered

unless the borrower secures it by a maritime lien on a prepaid trust account

registered on a UCC. If the note is not registered then it simply cannot be

negotiated and thus if the lender negotiated it, then it counts as a violation

and provides the right of rescission.

Conclusion

If you ever get a claim from a debt collection agency, there

is no need to worry. You do not have to pay anything to the debt collection

agency because they are not even the legal party to the original contract that

happened between you and your lender, however, you do need to provide the

proper response/rebuttal and do so within a timely manner. All it requires is a

little knowledge of the relevant laws to file a counter claim and here at

ZeroPoint University you will obtain all the knowledge and resources needed to

help you take action!